Short selling has long been a popular strategy for investors seeking to profit from declines in asset prices. The ProShares UltraPro Short S&P500 ETF (SDS) provides a leveraged tool for investors to participate in this strategy. SDS targets to deliver three times the inverse return of the S&P 500 Index. This article examines the performance of SDS, exploring its strengths and weaknesses as a short selling vehicle.

Understanding the trends of SDS performance is crucial for investors considering its use in their portfolios. We will delve into historical data, examining the ETF's profits over different spans. Furthermore, we will analyze the hazards associated with leveraged short positions and offer insights into effective risk management strategies.

- Factors shaping SDS performance

- Outcomes across various market scenarios

- Exposure mitigation approaches

ProShares UltraShort S&P 500 ETF (SDS): Navigating Market Downturns

Market shifts are an inherent characteristic of investing. While periods of growth can be exciting, declines present a unique set of opportunities. Investors seeking to hedge against downside exposure often turn to alternative investments such as the ProShares UltraShort S&P 500 ETF (SDS). SDS provides leverage by aiming to deliver twice the inverse return of the S&P 500 index. This means that when the market falls, SDS could experience a corresponding gain.

- Importantly, it is crucial to understand that leveraged ETFs like SDS are not for everyone. Their structure demands a higher level of expertise and they carry increased risk compared to traditional investments.

- Therefore, it is essential for traders to conduct thorough research their investment goals, appetite for risk, and the fundamentals of leveraged ETFs before implementing a strategy.

Keep in mind market conditions can fluctuate unpredictably, and more info past performance are not indicative of future performance. Always consult with a qualified financial advisor to assess the suitability of any investment strategy, including leveraged ETFs like SDS, for your unique situation.

Exploring SDS ETFs: Leveraged Short Selling Strategies on the S&P 500

For experienced investors seeking alternative approaches to capitalize on potential downturns in the S&P 500, leveraged short ETFs like SDS/SQQQ/SH offer a compelling vehicle/strategy/mechanism. These exchange-traded funds utilize derivatives/leverage/financial instruments to amplify the returns of a bearish/shorting/inverse market exposure. This article/The following analysis/In this comprehensive guide delves into the intricacies of SDS ETFs, exploring their mechanics, potential benefits/risks/rewards, and essential considerations for investors seeking to incorporate/utilize/implement them within a diversified portfolio.

- Understanding/Comprehending/Grasping the Leverage Multiplier: A Key Factor in SDS ETF Performance

- Risk Management Techniques/Strategies for Mitigating Losses/Balancing Risk and Reward in Leveraged Short Positions

- The Role of Index Tracking/How SDS ETFs Mirror S&P 500 Movements/Understanding the Underlying Index Impact on SDS Performance

Furthermore/Additionally/Moreover, this investigation/examination/analysis will shed light on/discuss/explore the potential for utilizing SDS ETFs in various investment scenarios/situations/strategies, including hedging/portfolio diversification/generating alpha.

Unlocking Potential with SDS: Shorting the S&P 500 for Profit

Harnessing the power of derivatives and calculated short selling within the dynamic S&P 500 landscape can be a lucrative endeavor for savvy investors. Deploying a well-designed Short Selling Strategy (SDS) involves meticulous market analysis, comprehensive risk management, and an unwavering commitment to capital preservation. By capitalizing on market inefficiencies and macroeconomic trends, astute traders can potentially generate substantial returns even in a bearish market environment.

Grasping Risk and Reward: The ProShares UltraShort S&P 500 ETF (SDS)

The ProShares UltraShort S&P 500 ETF (SDS) presents investors to a unique opportunity within the realm of alternative investments. This ETF aims to generate returns that are contrarily correlated to the performance of the S&P 500 index, meaning when the market rises, SDS is likely to fall. While this strategy can be appealing in turbulent market conditions, it's crucial for investors to thoroughly comprehend the inherent risks involved.

- A key aspect is the potential for substantial losses, particularly during times of market growth.

- Furthermore, the amplified nature of SDS can intensify both profits and losses.

- Consequently, it's essential for investors to diligently evaluate their risk tolerance and investment aspirations before considering an investment in SDS.

Finally, the decision to invest in SDS should be based on a thorough knowledge of its potential rewards and risks.

Understanding How to Short the S&P 500

The SPX, a widely recognized benchmark for the US stock market, presents both opportunities and risks for investors. While many seek to benefit through its upward momentum, others look to mitigate potential downturns. For those who believe a decline in the S&P 500's value, short selling via an ETF like SDS offers a tactical approach.

An SDS ETF, short for the ProShares UltraPro Short S&P 500, emulates the inverse performance of the S&P 500. This means that when the S&P 500 declines, the SDS ETF aims to increase in value by three times that percentage. This leveraged nature can {amplify{ profits for those predicting a market pullback, but it also magnifies potential losses if the market rises.

- Before initiating on a short selling strategy with SDS, it's crucial to conduct thorough research about the ETF's inner workings, risk factors, and market conditions.

- Furthermore, implementing proper risk management techniques, such as stop-loss orders, can help reduce potential losses.

Remember that short selling is a complex strategy that necessitates careful consideration and proficiency. It's not suitable for all financiers, and seeking advice from a qualified financial advisor is suggested.

Mr. T Then & Now!

Mr. T Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Destiny’s Child Then & Now!

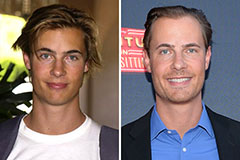

Destiny’s Child Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!